Pascal: The Ultimate AI Tool for Seamless Compliance and Risk Management

TL;DRPascal is the game-changer in AI-powered compliance and risk management. This innovative tool has never been more essential for financial institutions, insurance companies, and investment firms seeking to streamline their Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. With Pascal, you can enjoy exceptional speed and accuracy in compliance assessments, thanks to its AI-driven search engine that meticulously scans contacts and associated companies against sanction and Politically Exposed Persons (PEP) lists, as well as adverse media articles. The platform's continuous monitoring feature ensures real-time updates on clients or third parties, providing alerts when issues arise, thus reducing false positives and enhancing overall efficiency. Additionally, Pascal offers a user-friendly interface and seamless integration with Microsoft Azure, making compliance management simpler and more enjoyable. Whether you're optimizing risk management processes or complying with various European legislation protocols, Pascal is your trusted partner for navigating complex compliance landscapes with simplicity and confidence. Discover how Pascal can transform your approach to compliance with its cutting-edge features like continuous monitoring, intuitive interface, and customizable solutions.

2021-07-25

Simplifying Compliance with AI-Powered Precision: The Pascal Advantage

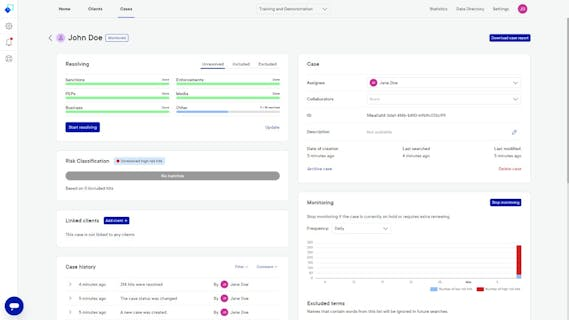

At the heart of Pascal lies an innovative suite of features designed to transform compliance management. This AI-driven tool streamlines KYC and AML processes, enhancing efficiency and accuracy in risk assessments. By leveraging advanced AI models, Pascal meticulously analyzes a range of open-source data and corporate-owned client-specific information, ensuring swift and accurate identification of compliance risks. One of the unique benefits of Pascal is its ability to reduce lengthy onboarding processes and minimize false positives. The platform’s intuitive interface and continuous monitoring capabilities make compliance management simpler and more enjoyable. Additionally, Pascal’s seamless integration with Microsoft Azure and customizable solutions ensure that it meets the diverse needs of financial institutions, insurance companies, investment firms, and other regulatory bodies. To provide a more detailed understanding, here are 8 key features that make Pascal an indispensable asset for compliance professionals:

Pascal's AI models are trained to analyze a range of open-source data and corporate-owned client-specific data, ensuring faster and more accurate compliance assessments. This feature is particularly beneficial for financial institutions and fintech companies looking to streamline KYC and AML processes.

Pascal offers a highly intuitive user interface that simplifies compliance management, making it easier for client-facing staff, compliance managers, and external auditors to collaborate and manage compliance tasks efficiently.

This feature keeps users up to date on their clients or third parties and the related risks to their organization. It provides alerts when issues arise, ensuring timely action can be taken to mitigate risks. This is crucial for financial institutions and investment firms that require real-time monitoring.

Thanks to AI-based techniques and self-learning, Pascal evolves along with constantly changing laws and regulations, giving increasingly accurate relevance predictions in far less time. This limits the number of false positives, saving time and resources for compliance teams.

Pascal reduces the complexity of onboarding clients and third parties, making the process faster and more efficient. This feature is beneficial for financial advisory firms and mortgage and loan companies that need to onboard clients quickly while ensuring compliance.

Every search and every decision is logged and compiled into a full audit trail. This provides assurance that the correct screening procedures have been followed and decisions have a sound basis. This feature is essential for regulatory and compliance bodies that require transparent audit trails.

Pascal can be synchronized with your Microsoft Azure account for swift deployment without workflow disruption. This seamless integration is particularly useful for businesses already using Microsoft tools, as it streamlines their compliance processes.

Pascal offers flexible pricing options, including a free plan with up to 10 free cases per month and a pay-as-you-go model at €0.25 per case. This flexibility allows businesses to choose the level of support that best suits their needs and budget, making it accessible to a wide range of organizations

- AI-Driven Compliance Efficiency

- Real-Time Monitoring Capabilities

- User-Friendly Interface

- Comprehensive Audit Trails

- Seamless Integration with Microsoft Azure

- Pricing Flexibility Limitations

- False Positive Risks

- Dependence on Data Quality

- Integration Complexity

- Customer Support Variability

Pricing

Pascal.vartion.ai offers a free plan with up to 10 free cases per month, including person checks, business checks, risk classification, resolving results, audits, reporting, and analytics. The paid 'Pay as you go' option is €0.25 per case, offering flexible billing based on the number of cases and add-ons. This includes person checks, business checks, reporting, risk classification, resolving results, audits, analytics, monitoring, and additional data sources. Users can select the package of resources they want to use and decide for themselves whether they opt for 24/7 monitoring.

Subscription

TL;DR

Because you have little time, here's the mega short summary of this tool.Pascal is an AI-powered compliance support platform that enhances efficiency and accuracy in KYC and AML screenings, offering real-time monitoring, seamless integration, and customizable solutions for financial institutions, insurance companies, and other regulatory bodies, with flexible pricing options including free trials and pay-per-case billing.

FAQ

Pascal is an AI-powered risk-based KYC & AML screening and monitoring platform. It uses AI models trained to analyze a range of open-source data and corporate-owned client-specific data, allowing users to assess findings faster and more accurately than other compliance tools. The platform automates the screening process, detects issues such as sanctions/PEP lists, and media information, making it easier to ensure KYC/CDD compliance.

Pascal reduces the complexity of onboarding clients and third parties by automating much of the process. It provides a clear overview and insights in just a few simple steps, making the onboarding process faster and more efficient.

Pascal provides continuous monitoring, keeping users up to date on their clients or third parties and the related risks to their organization. It offers alerts when issues arise, ensuring that no periodic checks are needed, and providing real-time alerts when necessary.

Pascal minimizes false positives through AI-based techniques and self-learning. It evolves with changing laws and regulations, providing increasingly accurate relevance predictions in less time. This reduces the number of false positives, allowing users to focus on what really matters.

Yes, Pascal is designed for effortless collaboration. Client-facing staff, compliance managers, and external auditors can access the platform, making it easier for teams to collaborate and profit from Pascal for their tasks and goals. The platform logs every search and decision, providing a full audit trail for transparency and assurance.

Skip to content

Skip to content

How would you rate Pascal?