Revolutionizing Financial Analysis with Hudson Labs

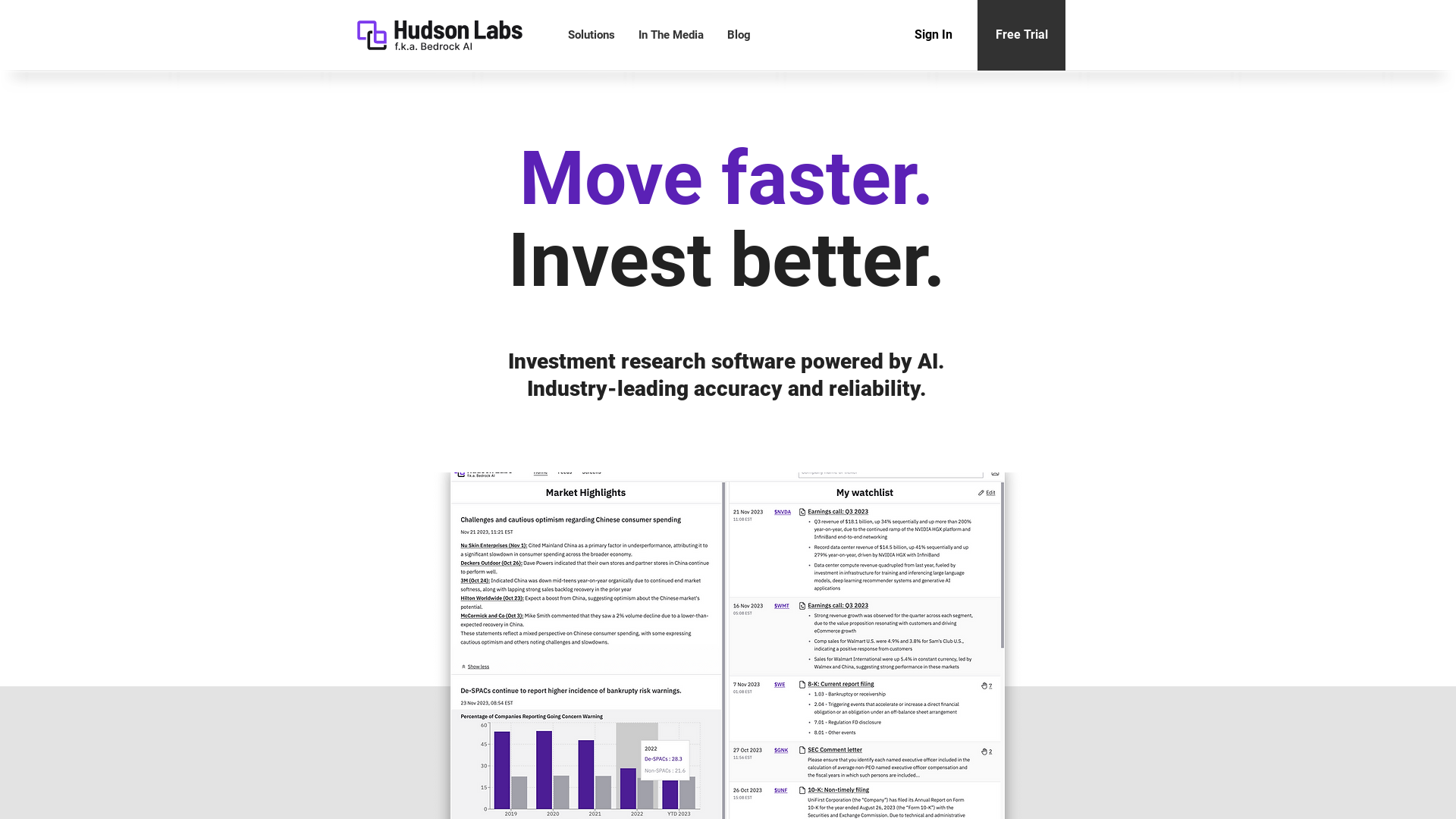

TL;DRHudson Labs is revolutionizing the world of financial analysis by providing cutting-edge AI tools designed specifically for asset managers, financial analysts, and investment research professionals. This innovative platform leverages proprietary Large Language Models (LLMs) and Natural Language Processing (NLP) architecture to deliver highly accurate and reliable financial insights. With its advanced noise suppression and relevance ranking techniques, Hudson Labs filters out irrelevant information, ensuring that users receive actionable and pertinent data. The tool's task-specific financial AI solutions address unique challenges in the financial industry, achieving near-perfect accuracy on complex financial tasks that generalist AI systems struggle with. Whether you're managing over $600 billion in assets under management or simply need to streamline your investment research workflow, Hudson Labs offers a powerful and effective tool for equity research. Discover how Hudson Labs can transform your approach to financial analysis with its industry-leading accuracy and reliability, making it an essential choice for professionals in the field.

2010-06-06

Transforming Financial Analysis with Hudson Labs

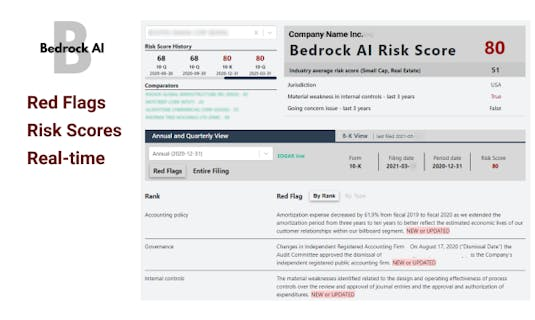

Hudson Labs is a pioneering AI tool designed to transform financial analysis by simplifying complex processes and enhancing productivity. This cutting-edge platform leverages proprietary Large Language Models (LLMs) and Natural Language Processing (NLP) architecture to provide highly accurate and reliable financial insights. One of the unique benefits of Hudson Labs is its ability to filter out irrelevant information and prioritize pertinent data through noise suppression and relevance ranking techniques. This ensures that users receive actionable insights that are both precise and concise, saving them valuable time and effort. The target audience, including asset managers, financial analysts, and investment research professionals, will find Hudson Labs to be a game-changer in their workflows. By automating tedious tasks and delivering accurate summaries, Hudson Labs empowers users to focus on high-level decision-making and strategic planning. To provide a more in-depth understanding, here are 8 key features that make Hudson Labs an indispensable asset for financial professionals:

Hudson Labs' proprietary LLMs are trained on over 8 million pages of corporate disclosures, providing exceptional accuracy and reliability in financial analysis. This training enables the models to understand complex financial jargon and legalese, distinguishing them from generalist models.

Hudson Labs' AI algorithms filter out irrelevant information and prioritize pertinent data, enhancing the quality of investment research. This feature ensures that only high-quality inputs are fed into the models, reducing the risk of hallucinations and improving output accuracy.

Hudson Labs' AI solutions are tailored to address unique challenges in the financial industry. This specialization allows the platform to provide industry-leading accuracy and reliability in tasks such as earnings call summaries and automated investment memos.

Hudson Labs achieves near-perfect accuracy on complex financial tasks that generalist AI systems struggle with. This high accuracy is crucial for financial professionals who require reliable and trustworthy data to make informed investment decisions.

Hudson Labs' software is built on proprietary Large Language Models (LLMs) and Natural Language Processing (NLP) architecture, developed in-house to meet the specific demands of the financial industry. This proprietary architecture ensures that the models are designed to handle financial text uniquely.

Hudson Labs' models have been trained on billions of words of financial text, exposing them to financial concepts, textual style, and structure. This contextualization helps the models distinguish between boilerplate and material information, providing more accurate summaries and memos.

Hudson Labs ensures that all summaries and memos are factual, credible, and auditable. This commitment to accuracy and transparency is essential for financial professionals who need to rely on trustworthy data to make informed decisions.

Hudson Labs' models have shown to outperform generalist chatbots like ChatGPT and Hila.ai in identifying business segments of public companies. This feature is particularly valuable for equity research analysts who need precise and accurate information to develop a differentiated view of the market[5

- Industry-leading accuracy and reliability in financial analysis tasks, especially with noise suppression and relevance ranking.

- Finance-specific models trained on extensive corporate disclosures for better financial acumen.

- Proprietary LLMs and NLP architecture provide robust data analysis and contextual understanding.

- Highly specialized AI solutions tailored to unique challenges in the financial industry.

- Supports end-to-end control of the analysis process to ensure factual and credible outputs.

- Generative AI hallucinations can lead to inaccurate information, especially in complex financial topics.

- Dependence on proprietary models might limit scalability and integration with other tools.

- High training data requirements (over 8 million pages of corporate disclosures) could be a barrier for smaller firms.

- Potential for noise suppression and relevance ranking errors in certain financial data.

- Limited contextual understanding of financial jargon and legalese in some cases.

Pricing

Hudson Labs offers custom pricing for institutional investors and enterprise customers. There is no publicly disclosed starting price, but the platform is known to serve clients with over $600 billion in assets under management. Notable features include extended trials available to MBA students, academics, and journalists, and a proprietary noise suppression and relevance ranking technique that achieves close to 100 percent accuracy on finance-specific tasks.

Subscription

TL;DR

Because you have little time, here's the mega short summary of this tool.Hudson Labs is a cutting-edge AI tool for equity research, leveraging proprietary large language models and NLP architecture trained on 8 million pages of corporate disclosures to provide highly accurate and reliable financial analysis, outperforming generalist AI tools like ChatGPT and Hila.ai by minimizing "hallucinations" and ensuring factual summaries, thereby enhancing efficiency and credibility in equity research workflows.

FAQ

Hudson Labs' AI tool stands out due to its specialized large-language models (LLMs) trained on over 8 million pages of corporate disclosures. This extensive training enables the tool to provide highly accurate and reliable financial analysis, outperforming generalist AI tools in tasks like earnings transcript summaries and equity research workflows.

Hudson Labs' noise suppression technique identifies and filters out irrelevant information, ensuring that only pertinent data is processed. This technique enhances the quality of investment research by reducing the amount of boilerplate text and improving the accuracy of the output.

The key features of Hudson Labs' AI platform include proprietary LLMs and NLP architecture, noise suppression, relevance ranking, and task-specific financial AI solutions. These features collectively enable the platform to achieve near-perfect accuracy on complex financial tasks.

Hudson Labs ensures reliability by breaking down complex tasks into subtasks, each tackled by specialized LLMs. This approach prevents the models from being put in positions where they are likely to fail, ensuring factual and credible outputs.

Using Hudson Labs for equity research offers several benefits, including faster time to insight, improved accuracy, and reduced friction in analyst work. The tool also provides proprietary noise suppression and ranking techniques, ensuring high-quality inputs and outputs.

Skip to content

Skip to content

How would you rate Hudson Labs?