Takeaways

– Nvidia announced its largest-ever acquisition, agreeing to buy Arm Ltd. for $40 billion

– The deal will significantly expand Nvidia’s reach in the chip market, especially for mobile and IoT devices

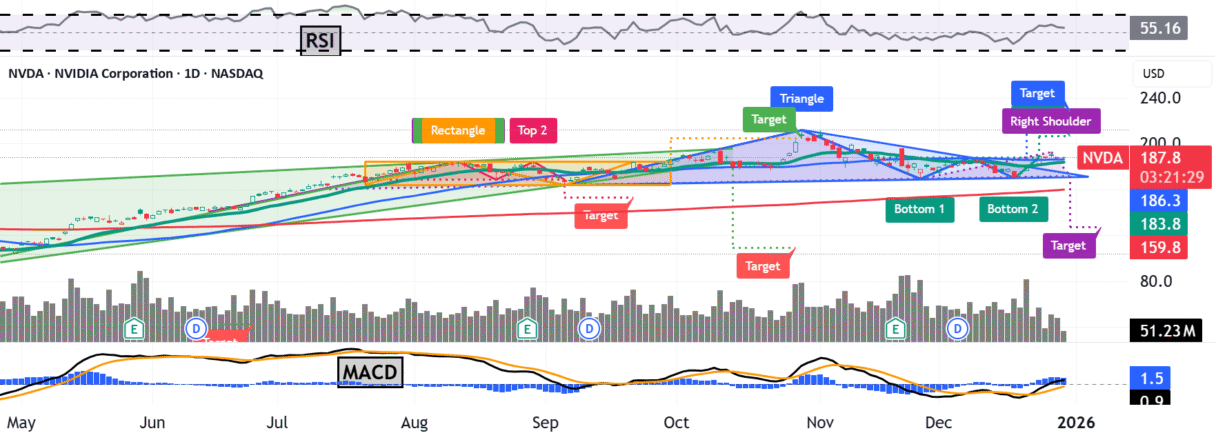

– Nvidia’s chart shows the stock price surging to new highs on the news, indicating investor optimism

– The acquisition faces regulatory hurdles and could take over a year to complete

– Analysts see the deal as a strategic move to compete with Intel and AMD in the fast-growing AI and edge computing markets

Nvidia’s Massive $40B Arm Acquisition Boosts Its Stock to New Highs

Nvidia announced on September 13, 2020 that it has agreed to acquire Arm Ltd. from SoftBank Group Corp. for $40 billion, in what would be the largest-ever acquisition in the semiconductor industry. According to Nvidia’s blog post, the deal will allow the company to “create the premier computing company for the age of artificial intelligence” by combining Nvidia’s AI expertise with Arm’s ubiquitous chip designs.

Nvidia Stock Surges on Acquisition News

Nvidia’s stock price jumped over 6% on the day of the announcement, reaching a new all-time high above $530 per share. The chart for Nvidia (NASDAQ: NVDA) shows a sharp upward trajectory following the news, indicating that investors are optimistic about the strategic benefits of the Arm acquisition.

**Performance and Capabilities:**

– Nvidia expects the combination to be accretive to its gross margin, operating margin, and earnings per share

– The company plans to maintain Arm’s open-licensing model and expand its IP licensing portfolio

– Nvidia will establish an Arm-based center of excellence in Cambridge, UK to foster innovation

**Regulatory Hurdles and Timeline:**

– The transaction is subject to regulatory approvals in the US, UK, China, and the European Union

– Nvidia expects the deal to close in approximately 18 months, facing intense scrutiny from antitrust authorities

**Strategic Rationale:**

– Nvidia aims to create the “world’s premier computing company for the age of AI”

– The acquisition will allow Nvidia to expand beyond its core GPU business into mobile, IoT, and edge computing

– Combining Arm’s widespread chip architecture with Nvidia’s AI expertise could produce powerful solutions for emerging markets

Conclusion

Nvidia’s blockbuster $40 billion acquisition of Arm represents a major strategic move to expand the company’s reach in the chip market. The deal will significantly bolster Nvidia’s position in fast-growing areas like mobile, IoT, and edge computing, where Arm’s chip designs are widely adopted.

While the transaction faces significant regulatory hurdles and a lengthy approval process, investors have reacted positively, sending Nvidia’s stock to new highs. Industry observers will be closely watching how Nvidia integrates Arm and leverages the combined capabilities to compete with industry giants like Intel and AMD in the AI and edge computing era.

FAQ

What is the rationale behind Nvidia’s acquisition of Arm?

Nvidia’s primary goal is to create the “world’s premier computing company for the age of AI” by combining its AI expertise with Arm’s ubiquitous chip architecture. The deal will allow Nvidia to expand beyond its core GPU business into fast-growing markets like mobile, IoT, and edge computing, where Arm’s chip designs are widely used.

How much is Nvidia paying for Arm?

Nvidia has agreed to acquire Arm from SoftBank Group Corp. for $40 billion, making it the largest-ever acquisition in the semiconductor industry.

What are the key benefits Nvidia expects from the Arm acquisition?

Nvidia expects the Arm acquisition to be accretive to its gross margin, operating margin, and earnings per share. The company also plans to maintain Arm’s open-licensing model and expand its IP licensing portfolio.

What are the regulatory hurdles the deal faces?

The Arm acquisition is subject to regulatory approvals in the US, UK, China, and the European Union. Nvidia expects the deal to close in approximately 18 months, as it faces intense scrutiny from antitrust authorities.

How has Nvidia’s stock reacted to the acquisition news?

Nvidia’s stock price jumped over 6% on the day of the Arm acquisition announcement, reaching a new all-time high above $530 per share. The chart for Nvidia (NASDAQ: NVDA) shows a sharp upward trajectory, indicating investor optimism about the strategic benefits of the deal.

What is Nvidia’s plan for Arm’s operations?

Nvidia plans to establish an Arm-based center of excellence in Cambridge, UK to foster innovation. The company has also stated that it will maintain Arm’s open-licensing model and expand its IP licensing portfolio.

How would you rate Nvidia’s Groundbreaking $40B Arm Acquisition: An AI Wonder?