🎯 KEY TAKEAWAY

If you only take one thing from this, make it these.

Hide

- Benchmark raised $225 million across two special purpose funds to invest in Cerebras Systems

- The move signals deep conviction in Cerebras’s wafer-scale chip technology and its IPO prospects

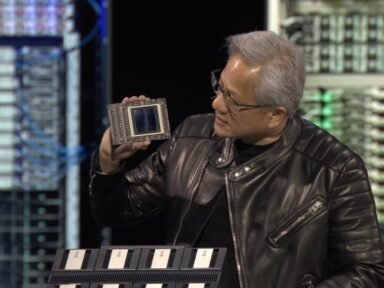

- Cerebras is a key player in AI training hardware, competing directly with Nvidia

- This funding provides Cerebras with significant capital and a strong vote of confidence from a top-tier VC firm

Benchmark Doubles Down on Cerebras With $225M Investment

Venture capital firm Benchmark has raised $225 million in two special purpose funds specifically to increase its stake in AI chipmaker Cerebras Systems. The investment, reported by TechCrunch on February 6, 2026, highlights the intense investor interest in companies challenging Nvidia’s dominance in AI hardware. Cerebras is known for its unique wafer-scale chips, which are designed to accelerate the massive computational demands of training AI models. This capital infusion positions Cerebras for a potential public offering and further expansion.

Cerebras Technology and Market Position

Cerebras differentiates itself from competitors by building a single, massive chip out of an entire silicon wafer, rather than cutting wafers into smaller individual chips.

Key Technological Advantages:

- Wafer-Scale Engine: The WSE-3 chip contains over 900,000 cores, enabling massive parallel processing for AI workloads

- Memory Bandwidth: Integrated memory on the wafer reduces data movement bottlenecks, a critical factor in AI training speed

- Scalability: Systems can be clustered to tackle even larger models, offering a scalable alternative to GPU farms

Strategic Impact:

- IPO Preparation: The special fund raise suggests Benchmark is preparing Cerebras for a public market debut

- Nvidia Competition: Provides a viable alternative for enterprises seeking to diversify their AI hardware supply

- Capital Efficiency: The $225M investment gives Cerebras substantial runway without diluting existing shareholders excessively

Industry Context and Future Outlook

The AI hardware race is intensifying as venture capital floods into startups aiming to break Nvidia’s near-monopoly on AI training chips.

Market Dynamics:

- Investor Confidence: Benchmark’s move is a strong signal that wafer-scale technology is seen as a credible long-term strategy

- Enterprise Demand: Companies are actively looking for hardware that can reduce training times and operational costs

- Supply Chain Diversification: The geopolitical climate has made hardware diversity a priority for many tech companies

What to Watch:

- IPO Timeline: Cerebras is now well-capitalized for a potential public offering in the near future

- Customer Adoption: Watch for major cloud providers or AI labs announcing partnerships or deployments

- Technology Iteration: The company will likely use these funds to accelerate development of its next-generation wafer-scale engine

Conclusion

Benchmark’s $225 million investment is a significant financial and strategic endorsement of Cerebras’s wafer-scale approach to AI computing. This funding not only provides Cerebras with the resources to scale but also positions it as a formidable contender in the high-stakes AI hardware market.

As Cerebras moves toward a potential IPO, the industry will be watching to see if its technology can deliver on the promise of faster, more efficient AI model training at scale. The success of this investment could reshape the competitive landscape, offering a credible alternative to Nvidia’s GPU empire.

FAQ

Why did Benchmark create special funds for Cerebras?

Benchmark raised $225 million across two special purpose funds to increase its stake in Cerebras, signaling strong conviction in the company’s technology and future prospects. This structure allows the firm to double down on a promising investment without affecting its main fund’s allocation.

What is Cerebras’s main technology?

Cerebras builds AI training hardware using a “wafer-scale” approach, where a single, massive chip is created from an entire silicon wafer. This design integrates millions of cores and vast memory bandwidth to accelerate AI model training significantly.

How does Cerebras compete with Nvidia?

Cerebras offers a fundamentally different architecture compared to Nvidia’s GPU clusters. Its wafer-scale chips are designed to handle massive AI models more efficiently by minimizing data movement and maximizing parallel processing on a single device.

Is Cerebras going public?

While Cerebras has not officially announced an IPO, Benchmark’s creation of special funds is widely seen as a preparatory step for a public offering. This type of investment often provides the capital needed to meet public market requirements.

What will the $225 million be used for?

The funds will likely be used to accelerate research and development, scale production, and expand sales and marketing efforts. It also provides Cerebras with a strong financial cushion as it competes with well-funded rivals.

What is the significance of this funding for the AI industry?

This investment highlights the growing demand for alternatives to Nvidia’s hardware. It shows that top-tier VCs are willing to place large bets on novel chip architectures to meet the exploding computational needs of AI.

How would you rate Benchmark Invests $225M in Cerebras’ Groundbreaking AI Chips?