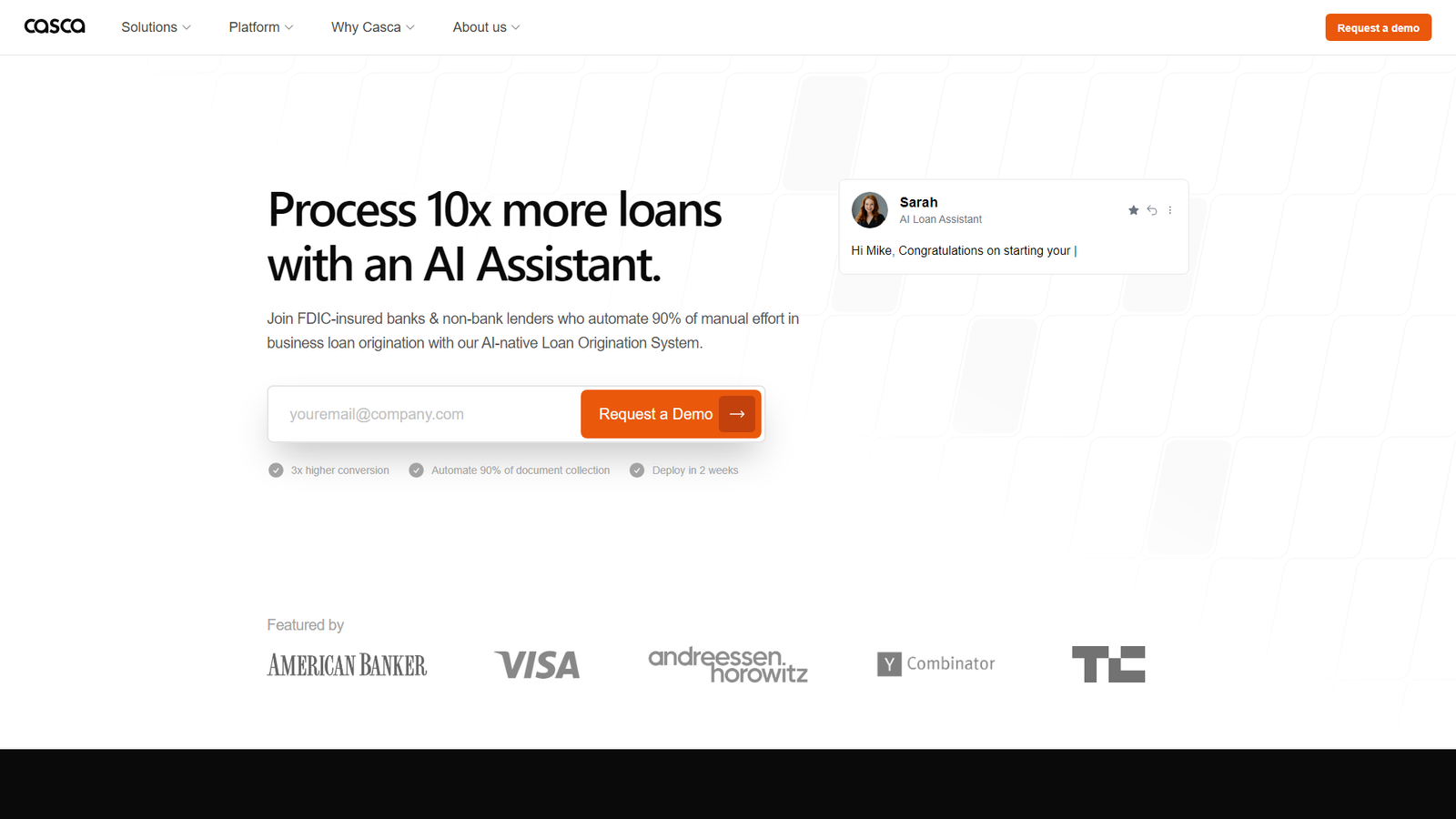

AI Automation Revolutionizes Lending: Introducing Cascading

AI automation is transforming industries, and finance is no exception. Enter Cascading, an innovative platform designed to streamline the lending process for banks, credit unions, and non-bank lenders. By leveraging advanced AI capabilities, Cascading automates document collection, customer communication, and loan analysis, freeing up valuable time for loan officers to focus on building relationships and closing deals. This results in a 10x faster loan processing speed, significantly reduced operational costs, and increased conversion rates. With its user-friendly interface, robust security features, and rapid deployment, Cascading is reimagining the lending journey for both lenders and borrowers.

Pricing

Casca doesn't explicitly list its pricing details on the provided website. The focus is on showcasing the benefits and features of their AI-powered loan origination system, emphasizing how it streamlines processes and improves efficiency for brokers and lenders. They encourage users to request a demo to learn more about specific pricing options tailored to individual needs. Key Points: No Explicit Pricing: The website does not state its pricing structure. Focus on Benefits: The content emphasizes the value proposition of Casca's AI-driven loan origination system, highlighting features like automation, efficiency, and improved customer experience. Request a Demo: The website encourages users to request a demo for personalized pricing information based on their requirements.

Skip to content

Skip to content

How would you rate Cascading?