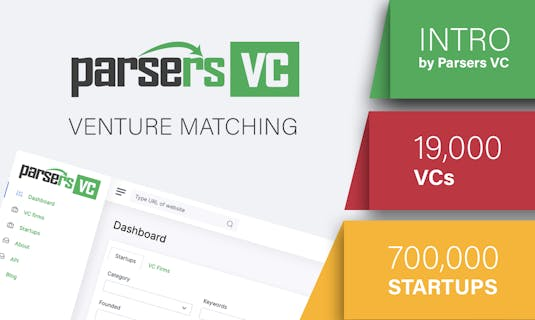

Revolutionizing Venture Capital with Parsers VC: Predictive Investments and Venture Matching Made Easy

TL;DRParsers VC has never been more essential for venture capitalists and startups alike. This innovative AI-driven platform offers predictive investment insights, venture matching, and comprehensive data collection, making it an indispensable tool for navigating the complex venture capital landscape. By leveraging advanced artificial intelligence algorithms, Parsers VC meticulously gathers and structures data from VC websites, tracking changes in portfolios, teams, and news. The platform integrates startups and VCs into a database through various methods, ensuring thorough coverage and up-to-date information. Key features include team analysis, news aggregation, funding rounds identification, and an AI-driven predictive investment algorithm that evaluates the investment potential of startups on 26 different parameters. With its user-friendly interface and API capabilities, Parsers VC simplifies the fundraising journey by effectively connecting startups with the right venture capital funds. Whether you're an active VC or a startup looking to secure funding, Parsers VC provides the tools and resources needed to make informed decisions and stay ahead in the competitive venture capital market. Discover how Parsers VC can transform your approach to venture capital with cutting-edge features like predictive investment analysis, venture matching, and real-time data integration.

2021-05-14

Revolutionizing Venture Capital with Parsers VC

At the heart of Parsers VC lies a powerful suite of features designed to transform venture capital workflows. This innovative tool offers a comprehensive solution that simplifies processes, enhances productivity, and empowers users to make informed decisions. By leveraging advanced AI algorithms, Parsers VC provides unparalleled insights into the venture capital market, including data on startup funding rounds, active venture capitalists, investments, and company valuations. One of the unique benefits of Parsers VC is its predictive investment algorithm, which evaluates the investment potential of startups based on 26 parameters. This feature, combined with its user-friendly interface and extensive database, makes it an invaluable resource for both startups and venture capital firms. Whether you're seeking to identify potential investment opportunities or connect with the right venture capital funds, Parsers VC streamlines the fundraising journey, ensuring you stay ahead of the competition. To provide a more in-depth understanding, here are 8 key features that make Parsers VC an indispensable asset for venture capital professionals:

Parsers VC leverages advanced AI algorithms to predict funding rounds based on 26 parameters, providing startups with a list of suitable VCs and vice versa.

The tool integrates startups and VCs into a vast database, ensuring thorough coverage and up-to-date information, accessible through the dashboard and various tabs.

Parsers VC collects structured data about employees of venture funds and startups, offering detailed insights into human resources and providing contact information including LinkedIn profiles and emails.

The tool utilizes NLP to analyze news from various sources, identifying key information and enriching the database with valuable insights.

Parsers VC detects and defines funding rounds, enriching the database with invaluable investment data and helping users track investment trends.

The AI-driven predictive investment algorithm evaluates the investment potential of startups on 26 different parameters, making it a standout feature for venture capital data providers.

The 'Venture Matching' service simplifies the fundraising journey by effectively connecting startups with the right venture capital funds, making it easier for both parties to find suitable matches.

Parsers VC offers a user-friendly interface with easy access to its features and regularly updated data, ensuring that users always have the latest information at their fingertips.

- Predictive Investments Algorithm

- Comprehensive Startup and VC Database

- Advanced Team Analysis Capabilities

- User-Friendly Interface

- Regularly Updated Data and Insights

- Data Accuracy Concerns

- Limited Customization Options

- Potential Overreliance on AI

- Pricing Plans May Not Suit All Budgets

- Customer Support Response Time

Pricing

Parsers VC offers a subscription-based pricing model with two main plans $26/month for accessing the Predictive Investments list and $59/month for the VC database. The platform provides flexible pricing options and custom quotes tailored to specific use cases.

Subscription

TL;DR

Because you have little time, here's the mega short summary of this tool.Parsers VC is an AI-driven tool that predicts funding rounds and matches startups with venture capital firms based on 26 parameters, offering a comprehensive dashboard, API access, and detailed analytics, making it a valuable resource for venture capital firms and startups seeking investment opportunities. Its predictive investment algorithm and venture matching service streamline the fundraising process, ensuring timely and relevant insights into the venture capital market.

FAQ

Parsers VC uses AI to match startups with potential investors, streamlining the venture capital process by analyzing startup data and investor preferences to suggest optimal matches.

The AI in Parsers VC analyzes startup data and investor preferences to suggest optimal matches, providing predictive insights based on market trends and past investment outcomes.

Yes, Parsers VC is designed to assist startups at various stages in finding compatible investors, making it a valuable tool for early-stage companies.

Investors benefit from Parsers VC by gaining access to a curated list of startups that match their investment criteria, facilitating efficient networking and investment decision-making.

Parsers VC emphasizes data security and privacy, ensuring that user data is protected and secure in its operations.

Skip to content

Skip to content

How would you rate Parsers VC?